#6 The Tale of AgeTech Unicorns

A closer look at AgeTech unicorns today and the white spaces they leave behind.

For innovators and investors exploring AgeTech, a central question is understanding the space’s track record: Which areas have generated notable success stories? Which have struggled to gain traction? And where does untapped white space remain?

A common benchmark for success in the startup world is achieving “unicorn” status, or a valuation of over $1 billion. The emergence of unicorns signals that a space has attracted significant venture capital and innovator interest. Conversely, the absence of unicorns suggests that the market is still in its early stages of development or has yet to capture the interest of top innovators and investors.

In this post, I take a closer look at the AgeTech unicorns that exist today with the goal to understand the evolution of the space tomorrow.

Here are my 3 main takeaways from this exercise:

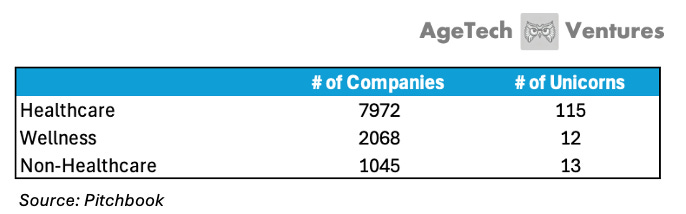

Healthcare dominates the AgeTech space today: Even though I explicitly included AgeTech investment themes that were not healthcare, 91% of the companies and 91% of the unicorns in the AgeTech universe were related to healthcare. This reflects the relatively mature and well-capitalized healthcare VC ecosystem compared to the nascent state of AgeTech more broadly.

Non-healthcare AgeTech has been largely overlooked: The scarcity of AgeTech unicorns outside of healthcare is mirrored by a general lack of startups entering those segments. As an optimist, one may interpret this as an under-explored opportunity, but practically this may also speak to the challenges of building in non-healthcare Agetech.

Market creation has yet to happen among non-healthcare AgeTech categories in a meaningful way: Estate / retirement planning was the only bright spot in the non-healthcare AgeTech universe, with 8 unicorns from the space. Estate / retirement planning companies benefit from existing, well-defined pools of spending that can be reallocated from incumbents to new entrants, with little need for market creation. This is different from most of the other areas of non-healthcare AgeTech, like home robotics for example (i.e., few people spend money on robotics for the home).

Defining the Universe

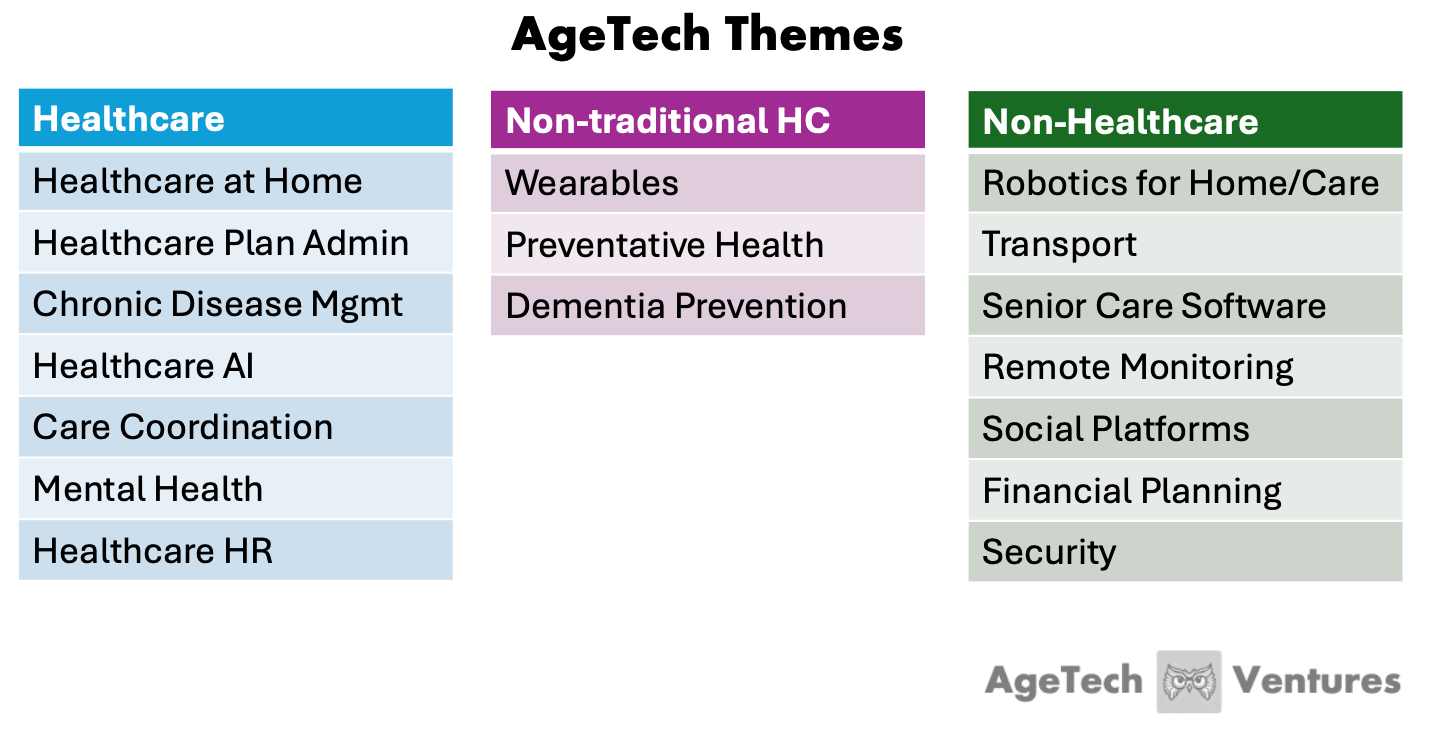

To start off, I mapped out the companies in the Agetech universe. Pitchbook does not have such a universe pre-defined, so I created my own taxonomy.

To do this, I used the AgeTech framework that I had developed in an earlier post as a basis (link). This anchored my search into the five categories of value props that AgeTech companies had to deliver on — Ikigai (“reason for being”), Autonomy, Health, Safety, and Caretaker Cost Efficiency. From these five broader categories, I refined my universe into 17 different themes that were sufficiently narrow to act as a filter for companies.

I chose to disaggregate wearables and preventative health solutions from general “Healthcare” companies as these sat outside of the traditional medical model of healthcare focused on the diagnosis and treatment of illnesses. I labeled this category of companies as “Non-traditional Healthcare” or “Wellness”.

As I looked through the data, I quickly discovered that healthcare (traditional and wellness/non-traditional) absolutely dominated the AgeTech universe, both by the number of companies and number of unicorns produced.1 Even though I had explicitly included non-healthcare AgeTech themes, 91% of the companies and 91% of the unicorns in the AgeTech universe were in healthcare.

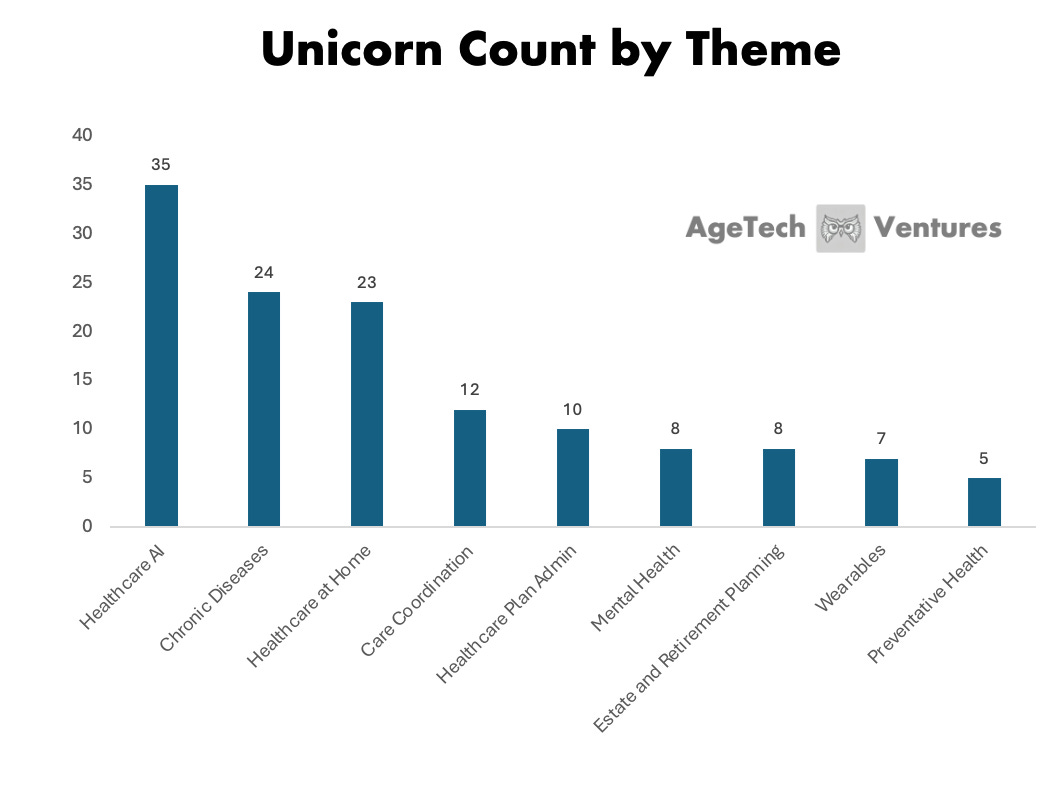

The following three themes accounted for the greatest number of unicorns in the AgeTech universe:

Healthcare AI (35 unicorns): There are many applications of AI in healthcare, including improved efficiency through enhanced diagnostic accuracy, streamlined administrative processes, personalized treatment plans, and others. Even though 2021-2024 was clearly a boon for the AI space, all but one of the 35 unicorns I found were founded before 2020. This suggests that applications of AI in healthcare take longer to scale than in other categories. The one exception? Hippocratic AI founded in 2023.

Chronic Disease Management (24 unicorns): Even though chronic disease is not an issue that exclusively applies to older populations, nearly 95% of older people have at least one chronic condition, and nearly 80% have two or more (link). Innovators in the space have developed a varied range of solutions for the diagnosis, monitoring and management of chronic conditions.

Healthcare at Home (23 unicorns): Nearly 2 million adults over 65 are completely or mostly homebound in the US, while an additional 5.5 million seniors can get out only with significant difficulty (link). The largest company in this space was Signify Health, focused on bringing clinicians into the home to identify and address chronic conditions and social determinants of health. Signify Health was acquired by CVS in 2023 for $8B (link).

Healthcare and AgeTech

I am not surprised that healthcare dominates the Agetech universe.

First, many aging problems are healthcare problems. This is why, once we get older, our wallet share spend on healthcare increases. In 2022, nearly 3 in 10 Medicare households spent 20% or more of their total household spending on health-related expenses, compared to 7% of non-Medicare households (link).

Additionally, the healthcare innovation ecosystem is a much more active than non-healthcare AgeTech. The healthcare VC ecosystem has tens of billions of capital raised each year and an established addressable market (link). There are enough success stories in healthcare that there is playbook of success to follow, and metrics and milestones to go alongside it.

This is a much friendlier space for entrepreneurs and investors compared to the relatively uncharted territory of AgeTech.

Just because healthcare is the lion share of AgeTech today doesn’t indicate that all of AgeTech should be healthcare.

Through the data, we observe that the lack of unicorns in non-healthcare pockets of AgeTech are also reflected by the lack of companies in the space.

The AgeTech ecosystem is significantly less mature than healthcare. It’s unfair to say non-healthcare AgeTech is a bad opportunity as opposed to one that has yet to be fully explored.

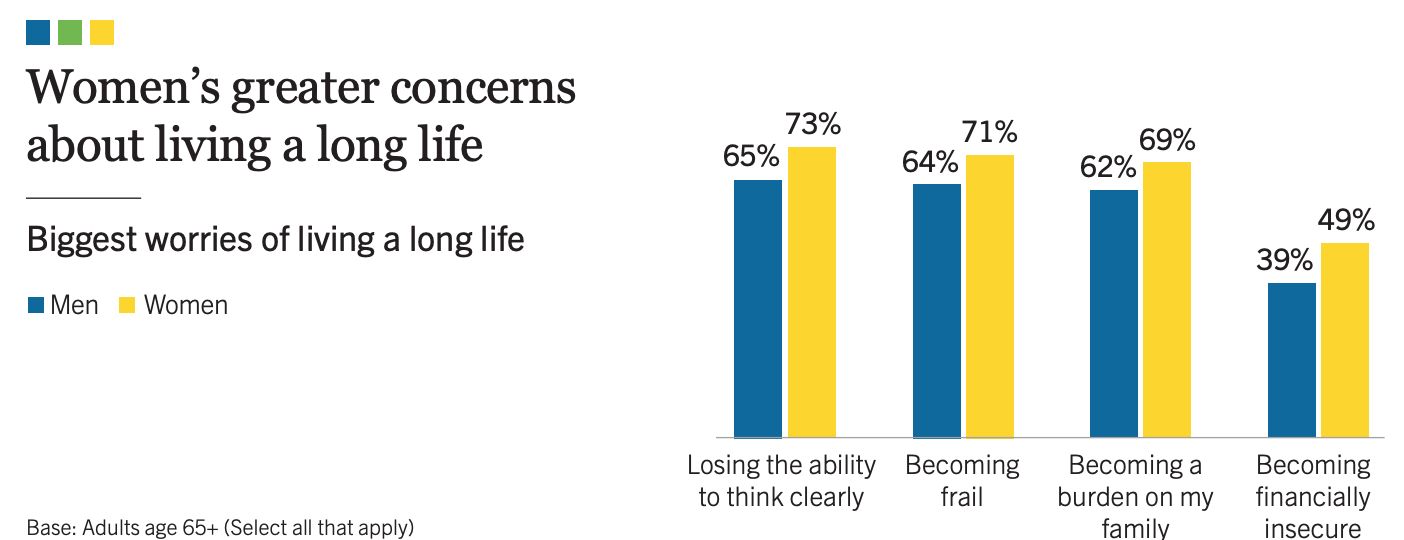

Most importantly, there is a strong need for solutions to the social consequences of aging, not just the health-related ones. In 2024, John A. Hartford partnered with Age Wave and the Harris Poll and asked adults age 65+ what they were most concerned about (link). The top four issues were: 1) losing the ability to think clearly, 2) becoming frail, 3) becoming a burden on family, and 4) becoming financially insecure.

While these issues are at least in part rooted in healthcare issues — for example, the cognitive impairment associated with Alzheimer’s — they can be ameliorated through solutions that do not directly address the disease. Accurate and affordable fall detection solutions, for example, can help to reduce the worry that families have for older adults aging-in-place.

This is especially important given that there is currently no medical “silver bullet” for aging. In some areas, scientific breakthroughs remain elusive; in others, existing medical interventions merely delay the onset of symptoms. As a result, many older adults are left grappling with the same challenges—just a few years later.

AgeTech (non-Healthcare) Unicorn Map

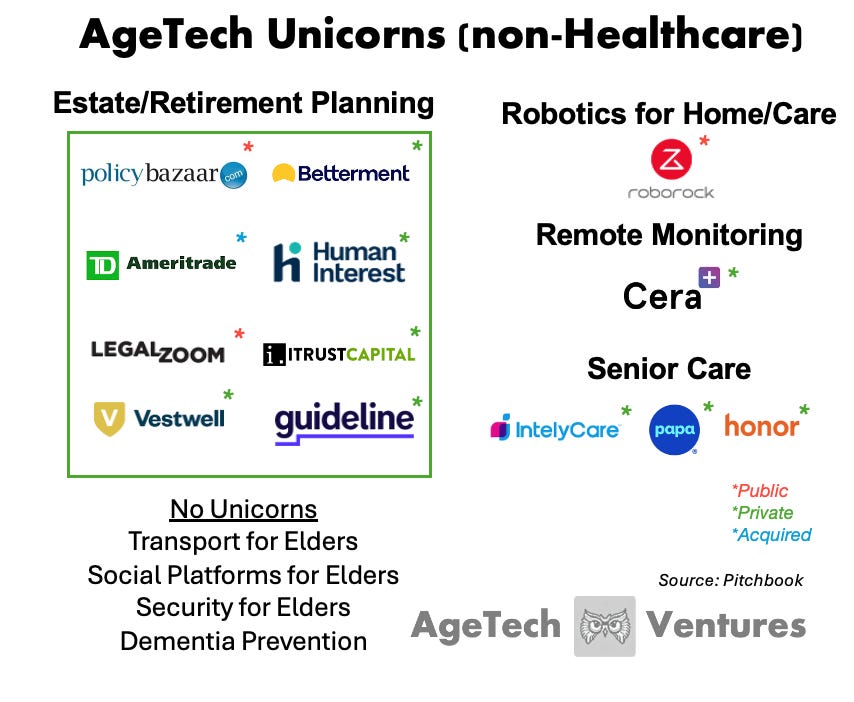

To better understand why there are not that many non-healthcare AgeTech companies, I looked more carefully at those that did exist. I quickly found that the distribution of unicorns in my AgeTech universe was still quite skewed. Estate/retirement planning (8 unicorns) accounted for the majority of unicorns, while other non-Healthcare AgeTech themes had at most a couple of unicorns within each category.

1. Unicorns in Estate and Retirement Planning

There were 8 unicorns in estate/retirement planning. Every single one of them were digital platforms that worked on one aspect of the space, whether this was 401(k) for small to medium-sized businesses (Human Interest and Guideline), Crypto IRA retirement solutions (iTrustCapital), or online legal services (LegalZoom).

I think the main reason that estate / retirement planning have multiple unicorns compared to the rest of non-healthcare AgeTech is because the category benefits from existing, well-defined pools of spending that can be reallocated from incumbents to new entrants. This means that there is little need for market creation. For example, 401(k) plans in the US already hold $4.9T of assets, so when new digital platforms come around, they are simply taking market share on the existing assets under management in 401(k) plans (link).

2. Unicorns in Senior Care

It is interesting to me that there are 3 unicorns that work in the senior care space— IntelyCare, Honor, and Papa. In my opinion, the shortage of caregivers is one of the most pressing themes in the AgeTech space. To illustrate this point, it’s worth understanding more about the caregiver support ratio. The caregiver support ratio is defined as the number of potential caregivers aged 45–64 years, the most common caregiving age range, for each person aged 80+. In 2010, more than seven potential caregivers were available for every person in the high-risk years of age 80. By 2030, the ratio is projected to decline dramatically to 4:1, and by 2050, it is projected to further decline to less than 3:1 (link).

IntelyCare, Honor, and Papa each have slightly different approaches, but all three essentially displace traditional home care services to connect families to caretakers with a certain level of tech enablement.

To take IntelyCare for example: IntelyCare is a healthcare talent platform that connects nursing professionals with job opportunities. The company reached unicorn status after its $115M Series C raise that valued the company at $1.1B in April 2022. The round was led by Janus Henderson, with participation from Longitude Capital, Leeds Illuminate, Endeavour Vision, Revelation Partners and Kaiser Permanente Ventures (link).

It’s hard not to think that COVID-19 may have provided a great tailwind to IntelyCare’s business. IntelyCare’s unicorn status was achieved on the back of impressive growth during this time: according to Pulse 2.0, IntelyCare’s annual revenue had grown by over 850% between 2020-2022. IntelyCare’s nursing professionals, known as IntelyPros, had more than doubled in 2021, while client demand for IntelyPros had almost tripled from the previous year (link).

Honor and Papa also reached unicorn status in 2021-2022.

3. Unicorn in Remote Monitoring

There is only one unicorn in remote monitoring — Cera.

Cera is a London-based tech-enabled home health care provider. The company reached unicorn status in Jan 2025 when it raised $150M led by BDT & MSD Partners and Schroders Capital.

Cera is a leading provider of home care and live-in care services in the UK, and has a network of professional caregivers. Cera has also developed an app that allows nurses and carers to collect, monitor and react to a range of vital health signs in their clients in real-time. This translates to up to 70% reduction in hospitalizations and cost savings for the payer (link).

According to Times, the majority of Cera’s revenues, which stood at £225 million in the year to December 2023, come from contracts to deliver care to elderly patients on behalf of NHS organizations and local authorities (link).

4. Unicorn in Home Robotics

When we think about home robots in the US, we think iRobot, but from a global perspective, we really should be thinking about Roborock, a Chinese company that specializes in robot vacuums and other smart home appliances. In 2024, Roborock recorded USD $1.65 billion of revenues, a 38% increase compared to the prior year (link). In contrast, iRobot recorded USD $680 million of revenues in 2024, a 23% decrease compared to the prior year (link).

This difference in growth trajectory is reflected in the valuations of the companies. While Roborock is worth more than $6 billion as of April 1, 2025, iRobot is only worth $80 million. In March 2025, iRobot issued a "going concern" warning, indicating substantial doubt about its ability to continue operations over the next 12 months (link).

iRobot’s valuation today is in stark contrast to the $1.7 billion price tag that Amazon was willing to pay in Aug 2022 (link). The company’s deep decline in value can be attributed to poor execution on growth efforts and increased competition in the space. This goes to reflect how difficult it is to build a great consumer home robotics business.

Biopharma innovations were excluded from the sample, including Healthcare AI companies for drug discovery for example. Chronic disease was defined to include heart health, diabetes (not type 1), hypertension, menopause, incontinence, osteoporosis, and arthritis. I only included companies that had received VC-funding in my dataset.