#10 Mapping the Senior Living Tech Stack

A look at the companies building the new operating system for senior living and integrating tech, teams, and data to meet the coming wave of aging adults

After attending the 2025 LeadingAge conference, the message was clear: senior living is at a pivotal moment. To meet the incoming demographic shifts, the way senior living communities are built, staffed and operated will have to change.

Given this, it’s a good time to reflect on the different components of the senior living tech stack, and to take stock in where the technology is in these different areas.

Why now?

As the first baby boomers turn 80 in 2025, many intuitively understand that we will face a surge in senior living demand, but few understand how astounding the demographic shifts described here are.

Between 2025-2030, the 80+ population in the US is projected to see 3-7% annual y/y growth, up from 1-2% growth from the decades prior. That means that the current 80+ population of 15 million is expected to reach 23 million by 2035, a 55%+ growth in just ten years.

Unfortunately, despite these demographic trends, construction of new senior living communities are at historical lows due to rising interest rates and construction costs.

This sets up a persistent senior living supply crunch that we will face over the next couple decades: in order to meet the growing needs of the aging population, the senior living industry must deliver 2x the number of new units annually compared to its historical peak for the next 20 years.

This supply shortage is compounded by the complexity of running a senior living operation today, where facilities face persistent workforce shortages, higher acuity residents, and increasing administrative burden. Technology can play a role in addressing these challenges.

Crash Course: Senior Living 101

Here are the main types of senior living facilities:

Skilled Nursing Facilities (SNFs - pronounced “sniffs”): Senior living facilities for older adults with complex medical needs. These facilities have 24/7 nurse coverage and physicians on staff. Can be separated between short-term rehab (short stays after inpatient hospital stays) and long-term care for high acuity patients. SNFs are often reimbursable through Medicaid and Medicare and are generally less profitable than other senior living models for this reason. A Department of Health & Human Services report found that Medicaid only reimburses 82 cents per every dollar of cost.

Assisted Living (AL): Senior living facilities for older adults who need assistance with activities of daily living, but wish to retain some level of independence and autonomy. The model was developed in 1981 by Keren Brown Wilson as an alternative to traditional nursing facilities that felt like hospitals as opposed to homes. Within AL, memory care facilities specifically serve older adults with Alzheimer’s or other dementias.

Independent Living (IL): Private apartments targeted to older adults with amenities such as dining services, housekeeping, transportation, and activity options on-site. There is no clinical care staff and this is usually paid entirely out-of-pocket.

Continuing Care Retirement Communities (CCRC): Senior living facilities where IL, AL, and SNF operations are all available on one site. Most require a sizable entrance fee to join ( > $300k), but monthly costs are more predictable on an ongoing basis. Compared to other models, they are more niche.

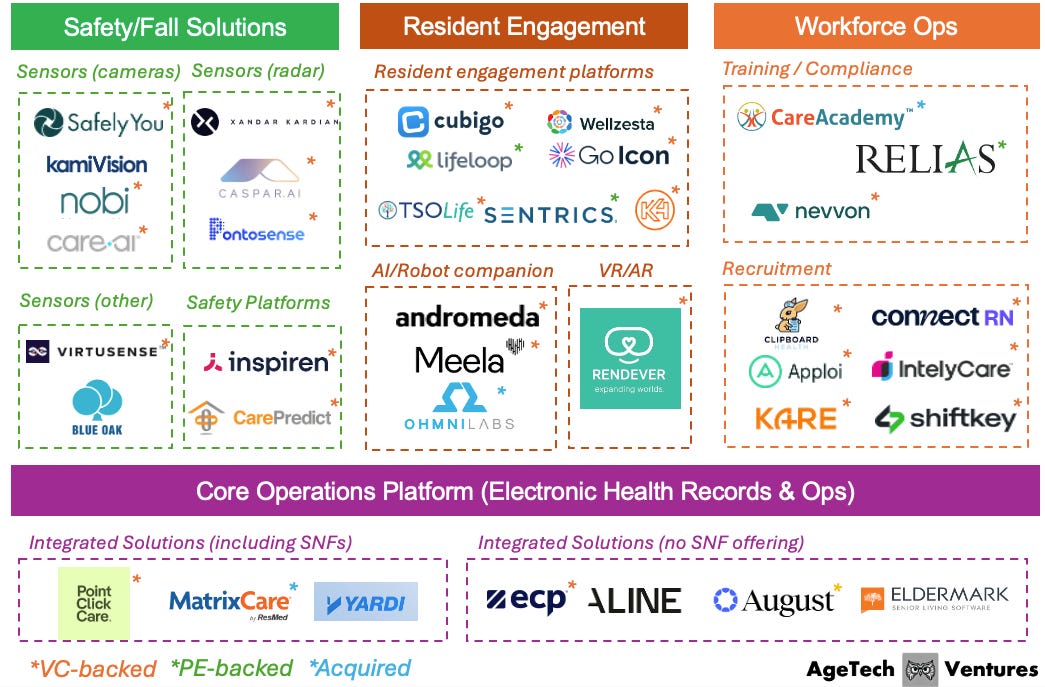

Senior Living Market Map

Historically, the tech stack in senior living has been fragmented: legacy EHRs, paper workflows, point solutions for emergencies, and ad-hoc tools for staff coordination. The result is duplication, inconsistent data, and limited ability to scale best practices across communities.

A new generation of software is emerging to act as the connective tissue of senior living operations. These tools sit closer to the workflow than to the billing office: they capture real-time activity on the floor, orchestrate staff, and surface insights about risk, wellbeing, and efficiency. As it stands, the senior living ops tech stack has great interoperability, with the proliferation of open API connectivity and cross-company collaborations.

In this market map, we break that landscape into four layers: Core Operations Platforms, Safety/Fall Solutions, Resident Engagement, and Workforce Ops. Together, they form an operating system for senior living, where resident data, staff actions, and building-level signals can flow across systems instead of living in silos.

Core Operations Platforms

Core operations platforms are the backbone of the senior living tech stack. These systems manage resident records, assessments, care plans, billing, and regulatory documentation, forming the system of record for clinical and operational data. Historically, these platforms were designed first for skilled nursing and were primarily electronic health record (EHR) solutions, with senior living layered on as an afterthought. Today’s operators need tools that reflect the realities of private-pay senior living, mixed acuity, and multi-site portfolios.

Next-generation platforms are shifting from passive databases to active operating systems. They support real-time tasking and workflows, integrate with point solutions (from fall detection to engagement tools), and expose analytics that allow operators to measure outcomes like hospitalization rates, length of stay, or staff productivity. For investors, these systems are strategically important: whoever owns the operating layer has a privileged position to orchestrate data and partner with (or absorb) adjacent solutions.

Key innovation themes

Companies in this category are leaning into the role of integration hub. The vast majority of companies in this space allow for free API integration processes, and are open to collaborating with early-stage startups. As an example, PointClickCare and MatrixCare now support hundreds of network partnerships and run independent software vendor marketplaces across a couple dozen solution categories.

Safety/Fall Solutions

Falls, elopements, and undetected health events are among the most costly and dangerous risks in senior living. Falls in particular make up more than 50% of liability costs for senior living providers. Historically, communities relied on staff rounding, pull cords, and basic nurse call systems. These tools are reactive and dependent on resident activation. As acuity rises and staffing ratios tighten, this model breaks down.

Safety and fall solutions use sensing technologies such as computer vision, radar, and other ambient sensors to continuously monitor motion and biometrics without requiring wearables or cameras in every room. These systems detect events like bed exits, unusual gait, or inactivity, allowing staff to intervene before a fall or medical emergency escalates. Beyond incident detection, platforms are beginning to aggregate sensor data over time to identify patterns and predict risk, enabling a shift from reactive to proactive care.

As fall detection sensors get better, senior living liability insurance providers are starting to take note and become natural distribution partners. CareAgents has partnered with Virtusense to develop unique policies that provide senior care operators with Virtusense’s fall prevention and fall detection products.

Key innovation themes

Simple threshold-based radar systems have historically suffered from high false positive rates, triggering “falls” when someone drops an object, sits down quickly, or when environmental noise confuses the signal. Newer players are pushing beyond basic radar by combining richer sensing with machine learning and gait analytics. Pontosense’s Silver Shield is a wall-mounted mmWave radar system designed specifically for aging care that monitors both motion and biometrics (breathing rate, heart rate, HRV) completely contactlessly. Other players have chosen to explore sensors outside of computer vision and radar, including Virtusense (LiDAR) and Blue Oak (Vibration).

Resident Engagement

For residents and families, “how it feels to live here” is as important as clinical care. Yet engagement has historically been analog—paper calendars, bulletin boards, and siloed life enrichment teams. This makes it hard to personalize programming, capture data on participation, or show families the impact of a community’s engagement strategy.

Resident engagement platforms digitize the social layer of senior living. They centralize calendars, communication, and content; support family and resident apps; and increasingly integrate with core platforms to tailor programming based on interests, cognitive status, and care needs. The next wave extends beyond software into immersive experiences and companionship, using robotics and VR/AR to reduce loneliness and support cognitive health.

Communication solutions, including those with an AI companion element, build on top of resident engagement platforms to deepen engagement. Companies are also bringing VR / AR technology into senior living to improve the wellbeing of residents.

Key innovation themes

AI is increasingly becoming the “front door” to resident engagement rather than just a back-end feature. Conversational agents, virtual companions, and social robots can meet residents where they are, whether this be voice, text, or touchscreens, and guide them to activities, answering everyday questions, and even initiating check-ins when behavior deviates from normal patterns. For residents who are anxious, cognitively impaired, or simply lonely, AI can function as a low-friction first interaction that nudges them toward human connection.

Workforce Ops

The senior living workforce is the critical bottleneck in the system. Communities are facing record turnover, wage pressure, and expensive reliance on agency staffing. Meanwhile, training and compliance requirements are increasing, and staff expectations are shaped by consumer mobile experiences rather than legacy LMS portals and paper schedules.

Workforce operations tools focus on two jobs: building and managing a high-performing workforce, and giving operators flexibility in how they source labor. Training and compliance platforms deliver bite-sized, role-specific education and track credentials at scale. Recruitment and staffing marketplaces connect communities to pools of W-2 or 1099 workers, often layering on dynamic pricing, ratings, and shift-matching algorithms. The most compelling solutions integrate directly with core operations platforms, pulling in acuity and occupancy data to inform staffing decisions.

Key innovation themes

To address staffing shortages, technology is enabling flexible labor models. These models provide more attractive arrangements for senior living staff (more schedule control and pay transparency) and allow operators to leverage on-demand workers while preserving quality and continuity.

Open Questions

Will tech actually solve the staffing crisis, or just make a smaller workforce more efficient?

There will be an estimated 8.9 million total job openings in US direct care workers from 2022 to 2032, and it is not yet clear that technology will meaningfully change that trajectory. Remote sensing tools have helped communities respond more effectively to falls, but they have not changed the underlying staffing ratios in buildings that already operate at or near minimum coverage. Workforce operations platforms can help senior living providers navigate labor shortfalls more intelligently, through on-demand labor, flexible scheduling, and better matching, but they still operate within a system where the core constraint is the number of people willing and able to do this work.

What is the right balance between AI vs. human engagement?

As AI technology advances and labor shortages become more acute, senior living communities are under pressure to lean more heavily on automation, virtual companions, and conversational agents to fill gaps in social and emotional support. The promise is compelling: AI can provide 24/7 coverage, proactive check-ins, personalized prompts, and low-friction engagement for residents who might otherwise withdraw. But many older adults experience these tools as a compromise rather than a benefit and feel uneasy about being “talked to” by machines. The open question is how far operators can lean on AI without eroding residents’ sense of dignity, autonomy, and genuine human connection.

Who will own the “operating system” layer and the data that flows through it?

There are many different players in the ecosystem, all looking to become a more comprehensive suite as opposed to point solutions. PointClickCare and MatrixCare are building marketplaces with hundreds of partnerships and open APIs; engagement platforms like TSOLife and Cubigo integrate deeply into EMRs, sales operations, dining, and maintenance; and safety vendors increasingly plug into core systems rather than remain standalone.

External work on senior housing innovation suggests that integrated, data-rich platforms will underpin future person-centered models. The open question is whether one or two core platforms become the de facto operating system for senior living operations, or whether a more federated model emerges, where data is portable, ownership is clearly defined, and operators can swap components without losing their history and analytics.

Closing Thoughts

Senior living is entering a decade defined by constraint and possibility: historically low construction, a rapidly growing 80+ population, and a workforce that is already stretched thin. Technology will not magically solve the supply gap or the staffing crisis, but it can meaningfully expand the effective capacity of the system by streamlining operations, reducing preventable risk, and deepening resident engagement.

The operators, investors, and founders who will matter most in this next chapter are those who treat tech less as a collection of point solutions and more as an integrated operating system, one where data can move, partners can plug in, and continuous experimentation is possible at the portfolio level. The open questions around staffing, safety ROI, and data ownership are not reasons to wait; they are the agenda for the next wave of innovation.

Thank you, very helpful

Great post!